Lifestyle

8 Old-Fashioned Grandparent Habits That Save Money

By Grace Kilander · November 19, 2025

Smart Savings From a Simpler Era

In a world of fast finance and one-click buying, the timeless wisdom of our grandparents has never been more valuable. Generations that navigated tougher economic times mastered the art of thrift out of necessity. Their common-sense habits weren't just about penny-pinching; they were about building a secure and stable life.These old-fashioned tips celebrate that enduring wisdom, offering simple, powerful ways to save money that work just as well today as they did decades ago. Get ready to embrace the smart, simple, and satisfying habits that built a generation. Image generated by Gemini

The Golden Rule: 'Waste Not, Want Not'

This classic phrase was the cornerstone of our grandparents' households. Nothing was thrown away if it could be used again. The next day, leftover vegetables from dinner were turned into a hearty soup, and bread crusts became breadcrumbs or croutons. This wasn't just about being frugal; it was a mindset of respecting resources.Today, with grocery prices soaring, this habit is a financial game-changer. Embracing the 'waste not, want not' philosophy can drastically reduce your food bill. By using leftovers creatively and finding new purposes for items you might otherwise discard, you honor this old-fashioned wisdom and keep more money in your wallet. Image generated by Gemini

The Simple Magic of Paying With Cash

Before credit cards and digital wallets, cash was king. Our grandparents understood something fundamental about money: it feels more real when you can hold it. Physically handing over bills for a purchase creates a psychological friction that tapping a card simply doesn't. This tangible connection to spending makes you think twice about impulse buys.Consider withdrawing a set amount of cash from your account for your weekly expenses. When you see the money in your wallet dwindling, you naturally become more mindful of where it's going, helping you stick to your budget and avoid the trap of easy credit card debt. Image generated by Gemini

The 'Envelope System' That Still Works Wonders

Long before budgeting apps, there was the envelope system—a brilliantly simple method for managing money. The concept is easy: at the start of the month, you divide your cash into labeled envelopes for different spending categories like groceries, gas, and entertainment.Once an envelope is empty, that's it. You can't spend any more in that category until next month. This physical boundary is incredibly effective at preventing overspending. Modern financial experts still praise this method because it forces you to make conscious spending decisions and live within your means. Image generated by Gemini

If It's Broke, Fix It! The Lost Art of Repair

Embrace the old-fashioned habit of fixing broken items instead of replacing them instantly. Like our grandparents, learn basic repair skills—mending clothes, fixing small appliances, and simple home maintenance—to save money and gain satisfaction. Try a tutorial before buying new. Image generated by Gemini

The Victory Garden: A Backyard Harvest of Savings

Embracing the tradition of 'Victory Gardens' and growing your own food is a powerful way to save money. Even a small plot, pots, or a windowsill can yield fresh produce, such as herbs and tomatoes, significantly reducing grocery bills. It's a healthy, affordable, and rewarding connection to the earth, just as our grandparents experienced. Image generated by Gemini

The Humble Brown Bag: A Secret Financial Weapon

Packing a lunch is a simple, highly effective way to save money, a habit our grandparents embraced. They wouldn't have wasted money buying lunch daily. Brown-bagging it, like bringing a thermos of soup or a homemade sandwich, can save you hundreds or even thousands of dollars each year, significantly impacting your finances. Image generated by Gemini

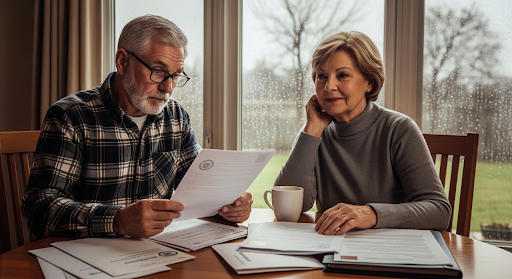

Their Biggest Lesson: Planning for a Rainy Day

Their key habit was planning for the unexpected. Our grandparents saved for a "rainy day," such as car trouble or sudden unemployment. Today, one of the biggest and most costly 'rainy days' we can face is the need for long-term care. Costs are staggering; in 2024, the median annual cost for a private room in a nursing home was nearly $127,750.Without a solid plan, a lifetime of savings can be wiped out in several years. Just as our grandparents planned for their future, future generations must plan for theirs. Protecting your hard-earned assets often requires specialized knowledge, so many families consult a Medicaid planning attorney to navigate the complexities and secure their financial legacy. Image generated by Gemini

Save Up Before You Buy

In contrast to 'buy now, pay later,' our grandparents practiced delayed gratification, saving up to pay for big-ticket items like cars or TVs in full. This avoids interest and debt, fostering true ownership and greater appreciation for the purchase. Saving for a goal is a rewarding achievement, offering a powerful way to control your finances. Image generated by Gemini

Timeless Wisdom for a Secure Future

Our grandparents' money-saving habits offer a blueprint for a secure, resilient life. These resourceful, common-sense practices teach us to live within our means and plan intentionally. Adopting them builds a stronger financial foundation, proving that age-old ideas are often the best.This article is for general information and should not be considered financial or investment advice. Consult a professional for your own financial needs. Image generated by Gemini