Business

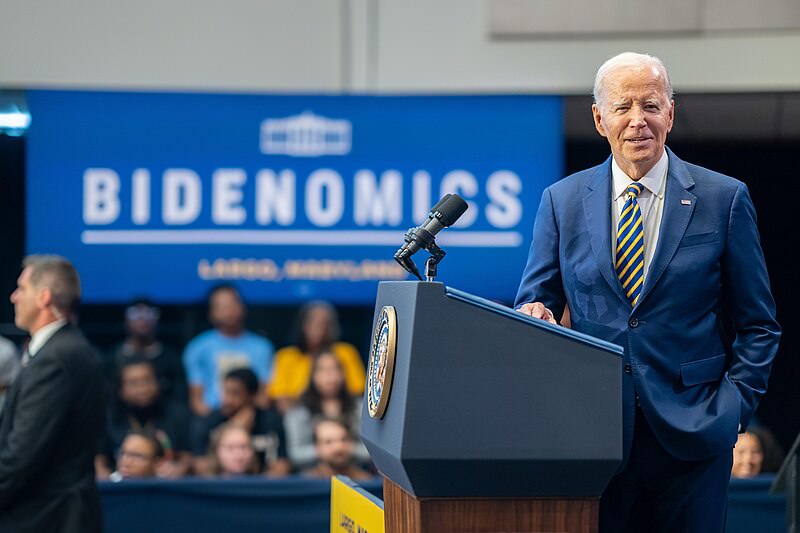

Debt crisis looming? Biden economic ratings sink

By Jake Beardslee · October 26, 2023

In brief…

- Delinquencies are rising on credit cards, auto loans, and mortgages as pandemic stimulus dries up

- Savings accumulated during COVID have now been depleted for most households

- Credit card debt has ballooned, exceeding $1 trillion in August

- Just 36% approve of President Biden's economic leadership despite falling inflation

- Auto loan delinquencies hit record highs while credit card late payments keep climbing

As Americans’ pandemic-era savings dwindle, more are struggling to keep up with payments. Delinquencies are rising across mortgages, credit cards, and auto loans as stimulus checks dry up and the Federal Reserve hikes interest rates.

Sixty-day auto loan delinquencies for subprime borrowers hit a record high 6.1% in September, per Fitch data. Ninety-day credit card delinquencies climbed to 5.1% from 3.4% last year, the Fed reports. Fitch Ratings called it “stress on consumer ability to repay.”

Credit card debt exceeded $1 trillion in August, 18% above 2021, per Equifax. Sixty-day lateness rose from 1.32% last year to 1.8% now. The Fed said second quarter delinquencies “saw the most pronounced worsening” post-pandemic.

Mortgages over 90 days late were 0.63% in Q2, up from 0.44% last year. Across all debt, 1.16% was over 90 days late, versus 0.84% in Q2 2021. The Fed said credit cards saw “extraordinarily low delinquency rates during the pandemic.”

Research suggests pandemic savingS of $2.1 trillion are gone, the San Francisco Fed found. A St. Louis car dealer told the Fed that “decreased savings and high credit card debt” are affecting business.

According to a survey by LendingTree, 64 percent of Americans are living paycheck to paycheck, without any significant savings. The White House touts its economic policies, but only 36% approve of Biden’s economic handling, an AP poll found.