Politics

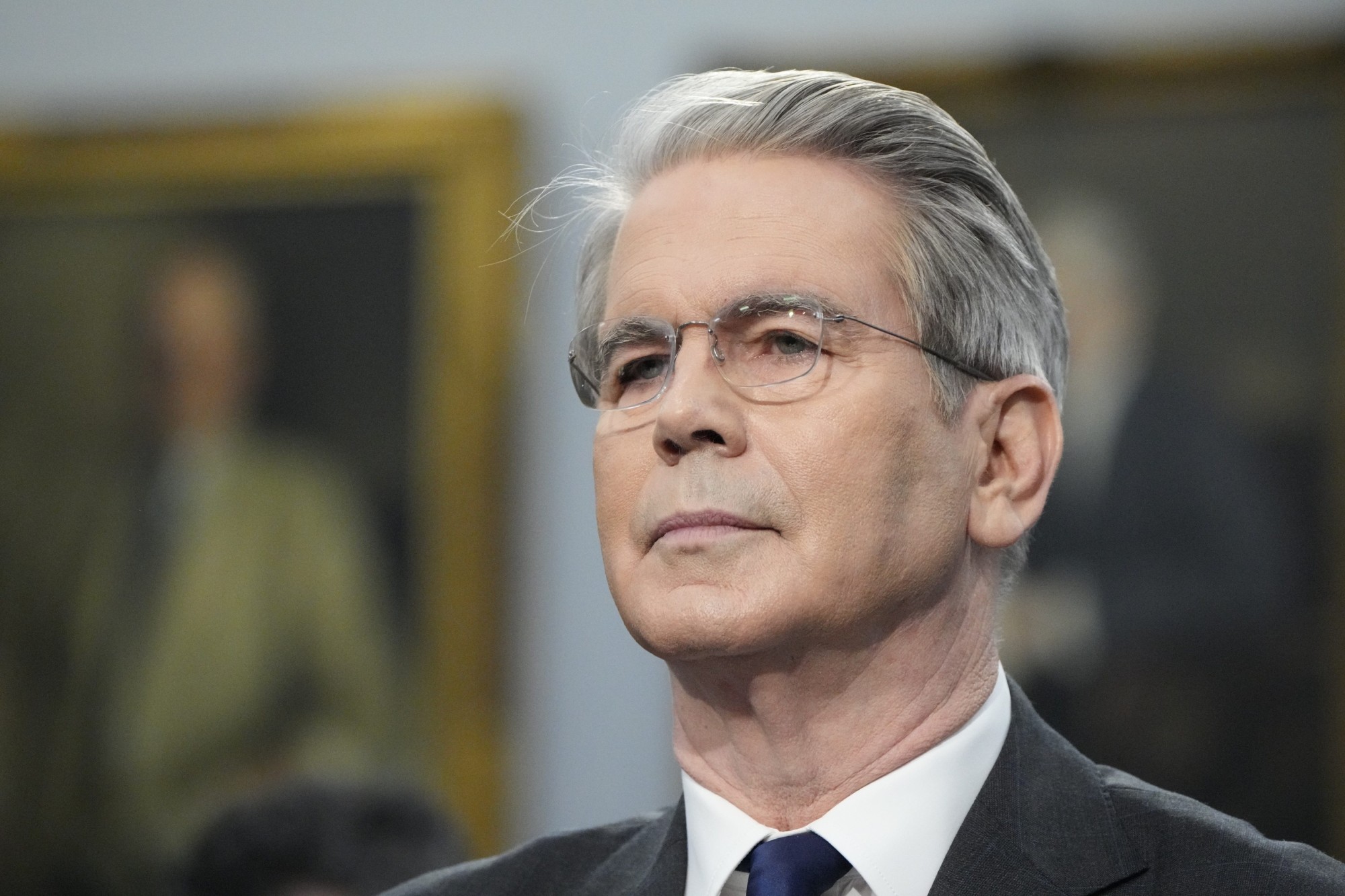

Bessent Says Tariffs Are Not a Form of Taxation

By Jake Beardslee · June 13, 2025

WASHINGTON — Treasury Secretary Scott Bessent faced tough questioning during a Senate Finance Committee hearing on Thursday after repeatedly denying that tariffs function as taxes, despite widespread agreement among economists and federal agencies.

During the hearing, Sen. Catherine Cortez Masto (D-Nev.) asked Bessent directly: “Do you think that tariffs are taxes?” Bessent responded, “No.” When pressed again, he reiterated, “No,” according to The Hill.

Tariffs are fees imposed on certain imported goods, and they are administered by U.S. Customs and Border Protection, which refers to them as “duties.” This terminology is commonly understood as another word for taxes. While debates continue about the effectiveness of tariffs as a trade policy, there is little disagreement among experts that they act as a form of taxation.

According to the Congressional Budget Office, tariffs imposed under President Trump’s policies are projected to generate between $2.4 trillion and $2.8 trillion in revenue over the next ten years. That figure is roughly equal to the deficit increase resulting from the GOP’s tax and spending cut package. Bessent, however, told the committee this alignment is “coincident, not causal.”

Trump has promoted tariffs as a key source of revenue and has floated the idea that they could entirely replace the income tax. “It’s possible we’ll do a complete tax cut,” he said in April. “I think the tariffs will be enough to cut all of the income tax.”

This claim has been met with skepticism from economists. Jesse Solis of the Tax Foundation wrote in an April analysis that “the individual income tax raises more than 27 times as much revenue as tariffs currently do.”

The Peterson Institute for International Economics also noted that “a tariff almost always increases the cost of imported goods by the full amount of the tariff rate.” This added cost is usually passed on to consumers or absorbed by businesses through reduced profit margins or adjusted operations.