Lifestyle

10 States Where Retirees Get More Bang for Their Buck

By Jake Beardslee · March 11, 2024

Mississippi

Leads with the lowest cost of living in the U.S. and housing costs about 30% below the national average. Despite its high utility costs, Mississippi offers a temperate climate and ranks among the safest states, with Biloxi and Oxford being attractive retirement locations. Justin Wilkens/Unsplash

North Carolina

With a cost of living 4% below the national average and a mild climate, North Carolina stands out. The state's diverse geography allows retirees to choose between mountain towns and coastal living, with Asheville and Wilmington being popular choices. Daniel Weiss/Unsplash

Delaware

Though small, Delaware boasts a low state income tax and no local sales tax, contributing to its appeal. Its charming towns and access to healthcare make it a great retirement choice, with Bethany Beach and Rehoboth Beach among the best places to retire. Josefina Lacroze/Unsplash

Wisconsin

Recognized for its affordable cost of living, especially housing costs more than 20% below the national average. Wisconsin offers a rich cultural scene and access to excellent healthcare, though retirees should be prepared for its cold winters. Tom Barrett/Unsplash

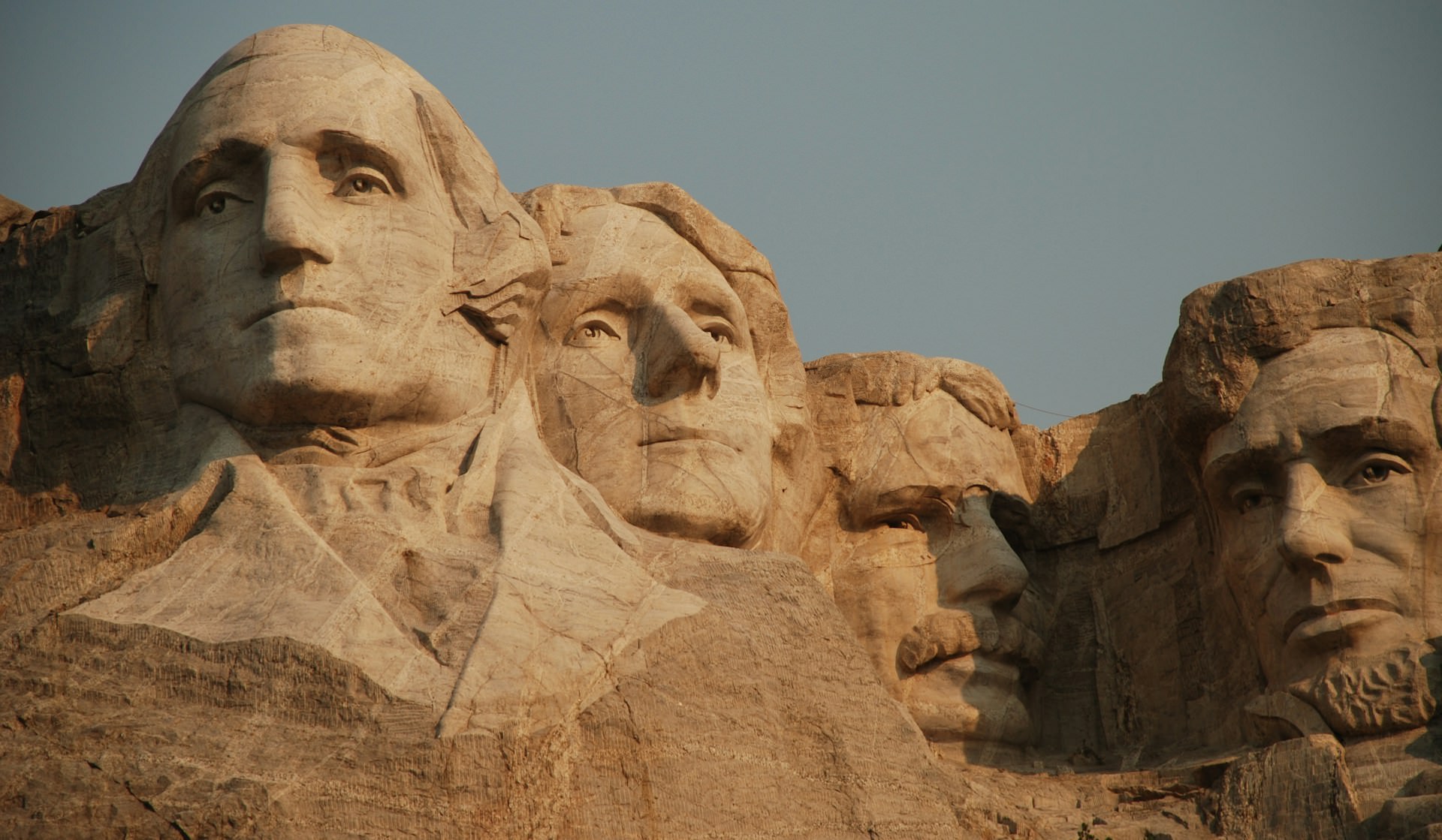

South Dakota

Attracts retirees with its history, outdoor activities, and no state income tax. The state's low cost of living and distinct seasons provide a balanced lifestyle for retirees looking for a mix of adventure and comfort. Ronda Darby/Unsplash

Pennsylvania and Florida (tie)

Both states offer significant advantages for retirees, including favorable tax policies and a high quality of life. Pennsylvania provides access to historic sites and cultural amenities, while Florida's warm climate and senior-friendly communities remain ever appealing. Heidi Kaden/Unsplash

Iowa, Tennessee, and Texas (tie)

These states do not tax distributions from 401(k) plans, IRAs, and offer no state income tax for Tennessee and Texas, making them financially advantageous for retirees seeking to maximize their retirement savings. Niko Vassios/Unsplash

Alabama

Offers a strong mix of affordability, with housing costs 30% below the national average and a low cost of healthcare. Its mild climate and established senior communities add to Alabama's charm as a retirement spot, with notable mentions like Huntsville and Gulf Shores. Clark Tibbs/Unsplash

Florida

Known as a retiree haven due to its sunny weather, no state income tax, and vibrant senior community. While the cost of living is close to the national average, Florida's appeal is enhanced by its healthcare quality and beautiful retirement destinations like Sarasota and St. Augustine. Jorge Vasconez/Unsplash