U.S. News

30 Everyday Products That Could Be Impacted by Rising Supply Chain Costs

By CM Chaney · August 8, 2025

This article sheds light on 30 everyday products that could become dearer or scarcer as global supply chain challenges continue to unfold. Delving into well-loved brands like Kellogg's and Nike, we explore how these changes could reshape daily consumption choices. As we navigate this evolving landscape, it's crucial to understand the driving forces behind these fluctuations and anticipate their impact on our shopping habits. Join us as we uncover the hidden intricacies behind these everyday essentials, each leaving a notable imprint on our lives. Gage Skidmore/Wikimedia

1. Breakfast Cereals: Rising Grain Prices Affecting Cheerios and Special K

Cheerios and Special K might be staples in many households, but their journey from fields to breakfast tables is fraught with challenges. Grain prices, driven by volatile weather patterns and geopolitical events, influence their cost dramatically. General Mills, the producer of Cheerios, and Kellogg's, known for Special K, are navigating these rising costs by exploring new supply chains and improving operational efficiencies. However, these adjustments come with a trade-off—potential price hikes for consumers. In a year where weather crises and labor shortages loom, keeping your cereal bowl full might become a more expensive affair daily. Photo by John Matychuk on Unsplash

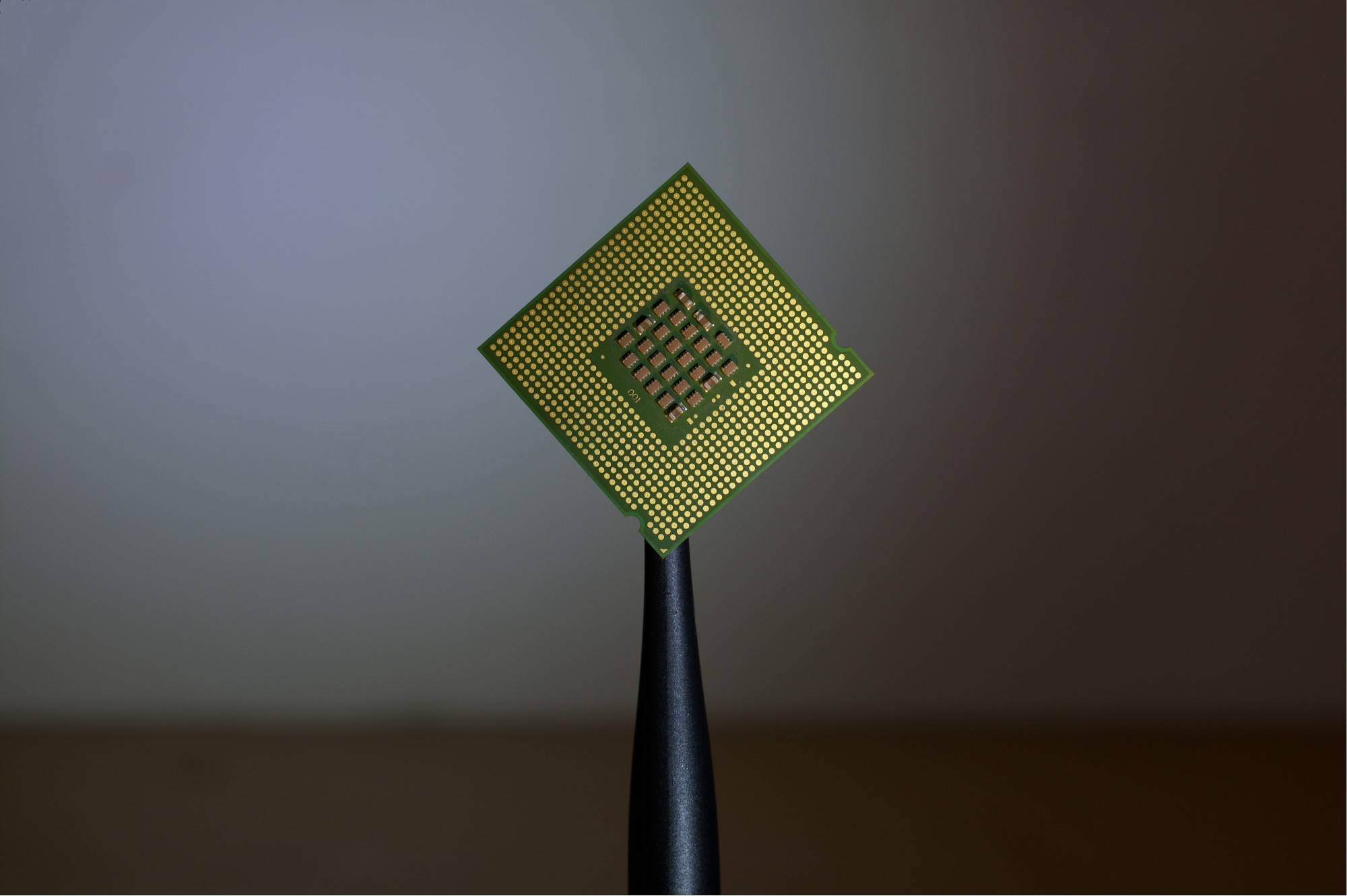

2. Electronics: Chip Shortages Impacting Apple and Samsung

The modern convenience of electronics is not without its vulnerabilities. Recent years have seen an unprecedented shortage of semiconductor chips, a crucial component for tech giants like Apple and Samsung. These shortages, spurred by factory shutdowns and increased demand during the pandemic, have disrupted production schedules and increased costs. Apple, for instance, has warned of supply constraints impacting products like iPhones and MacBooks. Meanwhile, Samsung has had to adjust its output schedules, delaying some product launches. For consumers, this means potential waiting lists for new gadgets or slight price increases as companies attempt to balance supply with demand. As the world becomes ever more reliant on technology, the tech industry faces an urgent need to innovate and adapt to these evolving challenges. Photo by Brian Kostiuk on Unsplash

3. Coffee: Bean Prices Affecting Starbucks and Dunkin'

The morning ritual of grabbing a cup of coffee might soon come at a higher cost. Coffee bean prices have been on the rise due to adverse weather conditions in key growing regions, such as Brazil's frost and drought. Starbucks and Dunkin' have both signaled potential price adjustments to account for these increased raw material costs. For Starbucks, this might mean higher prices for their premium blends, whereas Dunkin' may adjust their pricing strategy to sustain their competitive edge. Coffee lovers could face a dilemma—pay more for their favorite brews or pivot to alternative energy-boosting options. As climate change continues to play havoc with agricultural yields, coffee giants are exploring sustainable farming practices to ensure a steady supply. Photo by Anastasiia Chepinska on Unsplash

4. Footwear: Material Shortages Impacting Nike and Adidas

In the world of footwear, even iconic brands like Nike and Adidas aren't immune to supply chain disruptions. Shortages of raw materials, coupled with factory shutdowns in Asia—where much of their production takes place—are causing delays and potential price hikes. For Nike, this could mean longer waits for beloved sneaker launches. Adidas, on the other hand, might reassess its distribution strategies, focusing on flagship products over seasonal lines. These disruptions highlight the critical role raw materials and global logistics play in getting shoes from the design table to store shelves. As the sportswear giants strategize around these issues, consumers might need to brace for fewer sales and promotions. Photo by Domino Studio on Unsplash

5. Beverages: Aluminum Shortages Affecting Coca-Cola and Pepsi

The beverage industry is feeling the pinch of aluminum shortages, affecting giants like Coca-Cola and Pepsi. The increased demand for canned beverages during the pandemic coincided with production slowdowns, leading to a scarcity in aluminum supplies. As a result, Coca-Cola may focus more on producing their best-selling variants, prioritizing products like Coca-Cola Zero over less popular lines. Similarly, Pepsi might streamline its product range to optimize usage of available cans. Consumers could face limited availability of their favorite flavors or packaging variations. For companies, the challenge lies in balancing the demand spike for home consumption with these supply limitations. Photo by James Yarema on Unsplash

6. Household Paper Products: Pulp Shortages Affecting Procter & Gamble

Household paper products, from toilet paper to paper towels, are fundamental to daily life. Yet, pulp shortages have thrown a spanner in the works for manufacturers like Procter & Gamble, the makers of Charmin and Bounty. Driven by surging global demand and transportation hurdles, these shortages are raising production costs. Procter & Gamble is responding by adjusting their production strategies, though consumers may experience sporadic shortages and increased prices. During these times, maintaining stock for these essentials might require more strategic planning than usual, reminding consumers of early pandemic stockpiling days. Santeri Viinamäki/Wikimedia

7. Automobiles: Rising Costs for Ford and Toyota

The automobile industry is experiencing a tumultuous period with escalating costs affecting giants like Ford and Toyota. The shortage of semiconductor chips, as well as increases in steel and aluminum prices, has made vehicle production more expensive. Ford has already adjusted pricing for various models, while Toyota is deliberating similar measures. Consumers might find it challenging to purchase or lease vehicles at previous price points, potentially opting for fewer features or considering alternative brands. The industry is navigating these hurdles by investing in local supply chains and prioritizing high-demand models to maintain their market positions. Photo by Nadine E on Unsplash

8. Cleaning Supplies: Detergent Price Increases for Tide and Clorox

The demand for cleaning supplies has soared, particularly Tide and Clorox products, but so have prices for key ingredients like surfactants and disinfectants. As people continue prioritizing hygiene, the need for these products remains high. However, transportation costs and supply delays are leading to potential price increases. Tide is enhancing its production capabilities, while Clorox is exploring diversified sourcing strategies. For households, this could mean reassessing bulk purchase habits or trying store-brand alternatives when budgets are tight. Photo by Clay Banks on Unsplash

9. Clothing: Fabric Shortages Affecting Zara and H&M

Fashion retailers Zara and H&M are not immune to the global fabric shortage resulting from disrupted cotton and synthetic fiber supplies. The pandemic has exacerbated these issues, causing delays in collections and potential price hikes for consumers. Zara aims to mitigate these disruptions by reinvesting in digital fashion cycles and local manufacturing, while H&M is exploring sustainable materials to diversify offerings. Consumers might notice alterations in seasonal fashion availability or prices, prompting more strategic wardrobe planning. Photo by Amin Zabardast on Unsplash

10. Meat and Poultry: Cost Increases for Tyson Foods and Perdue

Meat and poultry prices are edging upwards, impacting major producers like Tyson Foods and Perdue. Labor shortages in processing plants and rising feed costs compound these price increases. To manage, Tyson is tweaking its supply chain efficiencies, while Perdue focuses on automation to reduce overhead. Consumers might notice smaller packaging or inflated costs for their favorite protein products, encouraging exploration of alternative meat substitutes or plant-based options emerging on the market. Photo by Tyson on Unsplash

11. Home Appliances: Delayed Releases From Whirlpool and LG

Home appliance manufacturers like Whirlpool and LG are grappling with the scarcity of essential components such as microprocessors and steel. The demand surge for home improvements during lockdowns has outpaced supply capabilities, delaying product launches and increasing prices. Whirlpool seeks solutions in diversifying its supplier network, while LG invests in innovative technologies to mitigate the dependency on constrained resources. As consumers hunt for appliances, the landscape might tilt towards flexible budgeting and consideration of off-brand products. Photo by Evy Prentice on Unsplash

12. Personal Care Items: Ingredient Shortages for Dove and Neutrogena

The personal care industry, notably brands like Dove and Neutrogena, faces the challenge of ingredient shortages. Essential oils and emollients, integral to moisturizing formulations and beauty products, are becoming scarce due to farming disruptions. While Dove considers alternative ingredients to maintain product efficacy, Neutrogena looks into eco-friendly solutions for steady supply. Consumers may experience intermittent shortages or higher prices for their essentials, redirecting focus towards versatile local brands. Photo by Akshay Bandre on Unsplash

13. Fresh Produce: Availability Issues Impacting Dole and Del Monte

Fresh produce suppliers like Dole and Del Monte are witnessing disruptions due to climate-related and logistical challenges. Adverse weather events have impacted crop yields, while transport bottlenecks affect freshness. Dole is scaling up its sustainability efforts, whereas Del Monte implements technological advancements to monitor agricultural conditions closely. Shoppers might see occasional reduced selection or hiked costs for fruits and vegetables, heralding the importance of supporting local farmers’ markets. Photo by Chandra Oh on Unsplash

14. Pet Food: Supply Chain Pressures on Purina and Pedigree

Pet owners are noticing the squeeze on pet food supplies, with vendors like Purina and Pedigree raising prices amidst ingredient shortages. The pandemic-induced demand surge, coupled with transport uncertainties and raw material constraints, necessitates rethinking cost strategies. Purina explores innovative plant-based ingredients to secure steady sources, while Pedigree invests in regional manufacturing facilities for consistent supply flows. This shift might prompt pet owners to consider alternative brands or DIY dietary solutions for their furry companions. Photo by Daniel Dan on Unsplash

15. Snack Foods: Cost Surges for Lay’s and Doritos

Snack food leaders Lay’s and Doritos are experiencing cost pressures due to increases in oil and staple prices. With sunflower and palm oils hitting new highs, these brands have to navigate cost management to prevent sales dips. Lay’s tries optimizing its ingredient sourcing strategies, while Doritos invests in alternative oil options to balance quality and cost. For snack lovers, price hikes on their preferred treats may open the door to considering new flavors or healthier snack alternatives. Photo by Gaining Visuals on Unsplash

16. Tea: Pricing Challenges for Lipton and Twinings

Tea aficionados might face a bitter reality as tea prices creep up, impacting brands like Lipton and Twinings. Unpredictable weather patterns in key growing regions affect yields, driving up costs. Lipton is exploring sustainable sourcing from diversified regions, whereas Twinings integrates fair trade practices more robustly to maintain quality and supply. Tea enthusiasts may need to familiarize themselves with alternative infusions or blends to keep their daily rituals within budgetary constraints. Photo by Crystal Tubens on Unsplash

17. Paper Goods: Cost Increases for Bounty and Scott

Paper goods like Bounty and Scott paper towels and tissues are becoming costlier due to rising demand coupled with material constraints. Increases in pulp prices and shipping delays push these brands to innovate with recycled materials and localized manufacturing. Bounty focuses on sustainable production adjustments, while Scott invests in flexible global supply solutions. Consumers could face an uptick in costs or the need to select less premium variants for routine purchases. Photo by Diana Polekhina on Unsplash

18. Bottled Water: Supply Chain Disruptions for Evian and Fiji

Supply chain disruptions are reshaping the bottled water sector, notably affecting brands like Evian and Fiji. Transportation bottlenecks lengthen the time taken from source to shelf, while packaging material costs rise. Evian leverages local bottling facilities for market-specific needs, whereas Fiji considers advancing alternative packaging innovations to counter these hurdles. For thirsty customers, this might mean adjusting purchasing habits or exploring functional water options for hydration. Photo by Jonathan Chng on Unsplash

19. Dairy Products: Volatility Impacting Land O'Lakes and Horizon

Dairy product supply chains have felt the pinch, affecting brands such as Land O'Lakes and Horizon due to feed price volatility and logistic constraints. Land O'Lakes innovates with digital farming tools to manage fluctuations, while Horizon prioritizes organic feed options for sustainable supply continuity. With dairy becoming pricier, consumers may venture into plant-based alternatives or transition to regional dairy sources as price checks ensue. TaurusEmerald/Wikimedia

20. Wine: Climate Challenges for Barefoot and Yellow Tail

The wine industry faces a tumultuous future as climate change impacts key wine-growing areas, influencing yields and quality. Brands such as Barefoot and Yellow Tail seek to mitigate these challenges with innovative vineyard management practices and climate-resilient grape strains. Meanwhile, wine lovers might experience a surprising uptick in price points, encouraging exploration into less affected wine-producing regions or emerging boutique brands. www.streetadvertisingservices.com/Wikimedia

21. Toys: Supply Chain Delays for Lego and Hasbro

Toys are enduring a topsy-turvy path, where companies like Lego and Hasbro handle distribution slowdowns and raw material constrictions. Rising costs of plastic resins and logistical challenges influence production timelines, prompting Lego to explore recycled materials and Hasbro to strengthen its digital footprint for global engagement. Parents might face higher costs during holiday seasons or need to plan purchases earlier to ensure availability. Photo by Nik on Unsplash

22. Jewelry: Metal Cost Increases Affecting Pandora and Tiffany

The sparkle in jewelry may soon demand a premium, as rising precious metal prices affect leading brands Pandora and Tiffany. The increased costs of gold, silver, and gemstones challenge their price structures. Pandora adopts ethically sourced metals for production, while Tiffany invests in artisanal craftsmanship to uphold its luxury status without excessively passing costs to consumers. The jewelers adapt as consumers find room to invest in timeless pieces or explore ethical jewelry options. Photo by __ drz __ on Unsplash

23. Chocolate: Supply Chain Pressures on Hershey’s and Cadbury

Chocolate lovers might find their guilty pleasures growing costly as brands like Hershey's and Cadbury face cocoa supply chain hurdles. Weather impacts in leading cocoa-producing regions elevate raw material costs. Hershey's is testing sustainable farming practices, while Cadbury invests in fair trade programs to ensure farmer stability and cocoa quality. Price increases may prompt chocoholics to consider boutique chocolate makers or diversify their sweet indulgences. Photo by Janne Simoes on Unsplash

24. Baking Supplies: Cost Increases for Betty Crocker and Duncan Hines

Home bakers might notice a pinch in their pantry as baking supplies see price surges, affecting brands like Betty Crocker and Duncan Hines. Rising prices for flour, sugar, and plastic packaging materials challenge these brands to optimize manufacturing costs. Betty Crocker explores organic and local sourcing, while Duncan Hines innovates with eco-friendly packaging to alleviate cost pressures. Shoppers could adjust baking habits or explore economical homemade ingredient alternatives. Wikimedia

25. Canned Goods: Inflation in Campbell's and Progresso Products

Canned goods are a pantry staple that is not immune to supply chain woes, affecting Campbell's and Progresso. Metal can shortages and increased transport costs drive potential price hikes. Campbell's explores cost-efficient logistics adjustments, while Progresso invests in streamlined inventory processes for consistency across its supply chain. As canned goods experience inflation, focusing on fresh alternatives or bulk purchase planning might benefit budget-conscious households. Photo by Kelly Common on Unsplash

26. Seafood: Sustainable Sourcing Efforts by Bumble Bee and Gorton's

The seafood industry thrives on complex supply networks, wherein brands such as Bumble Bee and Gorton’s face sustainability challenges amid fluctuating catch yields and increased regulatory norms. Bumble Bee invests in aquaculture advancements for reliable sources, while Gorton's explores traceable, eco-friendly fishing methods. Consumers might see steady price inflations or need to search for locally sourced seafood options to make environmentally considerate and wallet-friendly purchases. Photo by Max Mota on Unsplash

27. Frozen Foods: Distribution Hurdles for Green Giant and Birdseye

The convenience of frozen foods is interwoven with supply complexities, influencing brands like Green Giant and Birdseye. Labor shortages and increased refrigeration costs from farm to table elevate production hurdles. Green Giant pioneers locally sourced supply chain partnerships, while Birdseye bolsters sustainable farming practices to retain costs. Consumers might adjust meal plans and explore on-demand user-friendly recipes or bulk storage solutions in adaptation. Photo by JC Gellidon on Unsplash

28. Cleaning Products: Supply Challenges for Mrs. Meyer's and Method

Eco-conscious cleaning products like Mrs. Meyer’s and Method navigate ingredient shortages amid growing demand for ethical alternatives. Scarcity in essential oils and sustainable packaging aligns brands to community-driven resource networks to offset this volatility. Mrs. Meyer’s encourages refillable programs, while Method innovates zero-waste trails for household value and retention. For eco-enthusiasts inclined toward sustainable cleaning, refactoring daily habits and usage optimizations benefit resourcefully. Photo by Giorgio Trovato on Unsplash

29. Energy Drinks: Market Conditions for Red Bull and Monster

The energy drink arena is awash with supply chain trials affecting Red Bull and Monster, tasked with managing carbonated beverage ingredients amidst transport hiccups and price hikes for sweeteners and caffeine sourced offshore. Red Bull harnesses local energy alternatives while Monster capitalizes on reformulated flavors using plant-based elements. With consumer preferences adapting, popularity strides toward zero-sugar variants or functional beverage pursuits supplementing health-driven lifestyle choices. Photo by Jesper Brouwers on Unsplash