Business

Oil Prices Plunge to 4-Year Lows as China Strikes Back at U.S. Tariffs

By Jake Beardslee · April 9, 2025

China Hits U.S. Imports With Tariffs Up to 84%, Oil Prices Drop

Oil prices tumbled to fresh four-year lows on Wednesday after China announced steep new tariffs on U.S. imports, sharply escalating tensions in the ongoing trade conflict with Washington. According to China’s finance ministry, tariffs on American goods will surge to 84% from the previously declared 34%, beginning Thursday. This move follows President Donald Trump's decision to implement 104% tariffs on Chinese imports, which came into effect early Wednesday. wetpainthtx / Pexels

Oil Prices Plunge to Four-Year Lows Amid Tariff Shock

The market responded swiftly. Brent crude futures fell by $4.02, or 6.4%, landing at $58.80 per barrel, while U.S. West Texas Intermediate (WTI) crude dropped $4.03, or 6.76%, to $55.55. Although some of the losses were later recovered, both benchmarks had already fallen for five consecutive sessions. Burak The Weekender / Pexels

Rystad: Recession Fears Grow as China Retaliates, Oil Demand at Risk

Ye Lin, vice president of oil commodity markets at Rystad Energy, noted, "China's aggressive retaliation diminishes the chances of a quick deal between the world's two biggest economies, triggering mounting fears of economic recession across the globe." Lin warned that China’s oil demand growth—between 50,000 and 100,000 barrels per day—could be jeopardized if the dispute continues, though government stimulus may cushion the blow. Kaboompics.com / Pexels

EU Prepares to Join China and Canada in U.S. Trade Fight

The European Union is also expected to introduce retaliatory measures against the U.S., joining Canada and China in pushing back against Washington’s trade policies. Kaboompics.com / Pexels

Analyst: White House Oil Price Goals ‘Delusional,’ May Backfire

Ashley Kelty, an analyst at Panmure Liberum, offered a blunt critique: "Some U.S. analysts suggested that the White House wants to drive oil prices closer to $50... We see this goal as somewhat delusional... and (it) will merely see U.S. production shut in and open the door for OPEC to reclaim its position as the swing producer." Dominik Gryzbon / Pexels

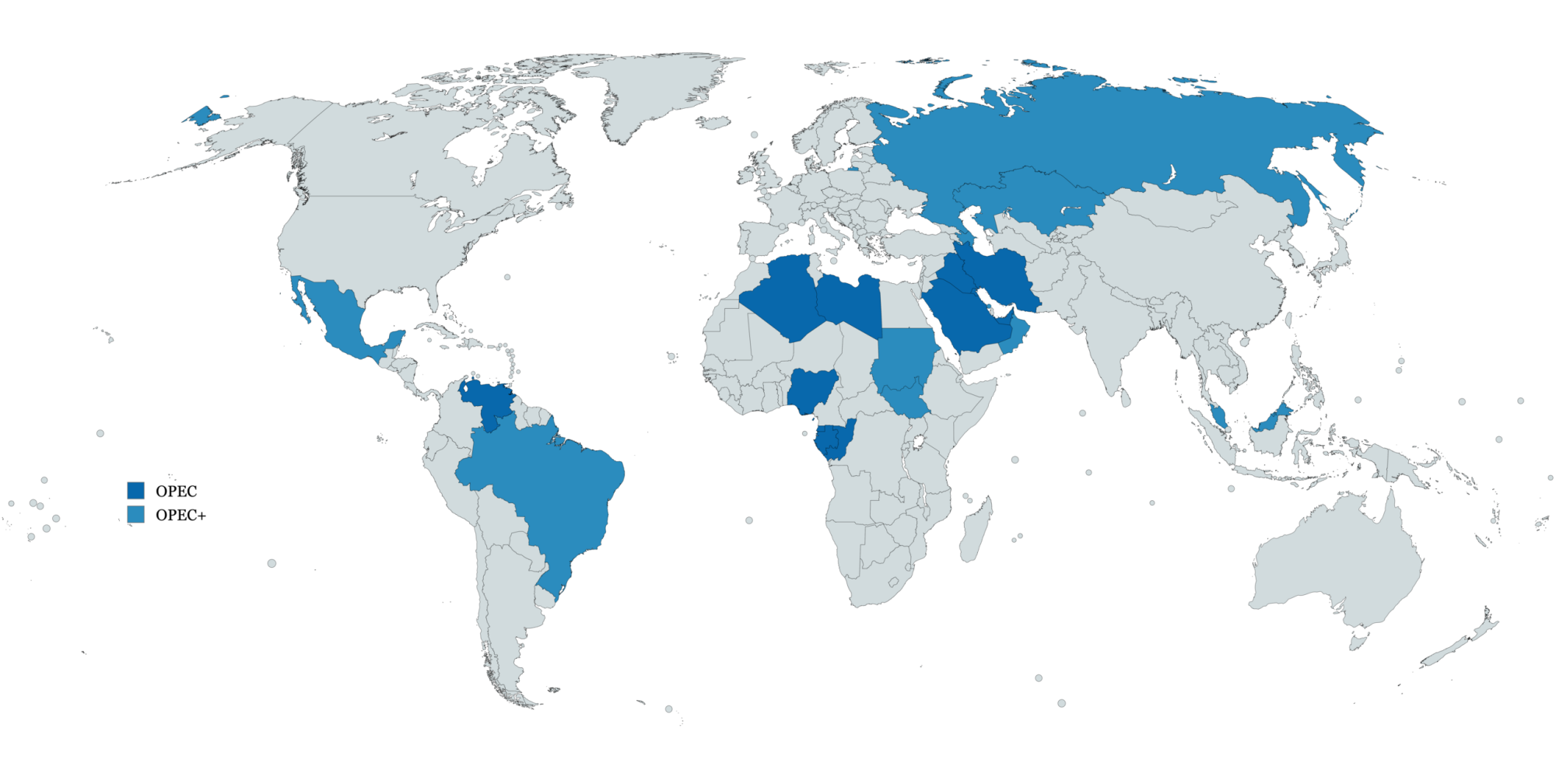

OPEC+ Output Hike Adds to Glut as Goldman Sees Further Price Drops

Adding to the downward pressure, the OPEC+ alliance has agreed to raise production in May by 411,000 barrels per day, a move likely to tip the market into oversupply. Goldman Sachs forecasts oil could drop further, projecting Brent at $62 and WTI at $58 by the end of 2025, and even lower in 2026. GianlucaAgostini / Wikimedia

Russia’s ESPO Crude Falls Below $60 Price Cap for First Time

Meanwhile, Russia’s ESPO Blend crude dipped below the Western price cap of $60 per barrel for the first time on Monday. Jan Zakelj / Pexels