Business

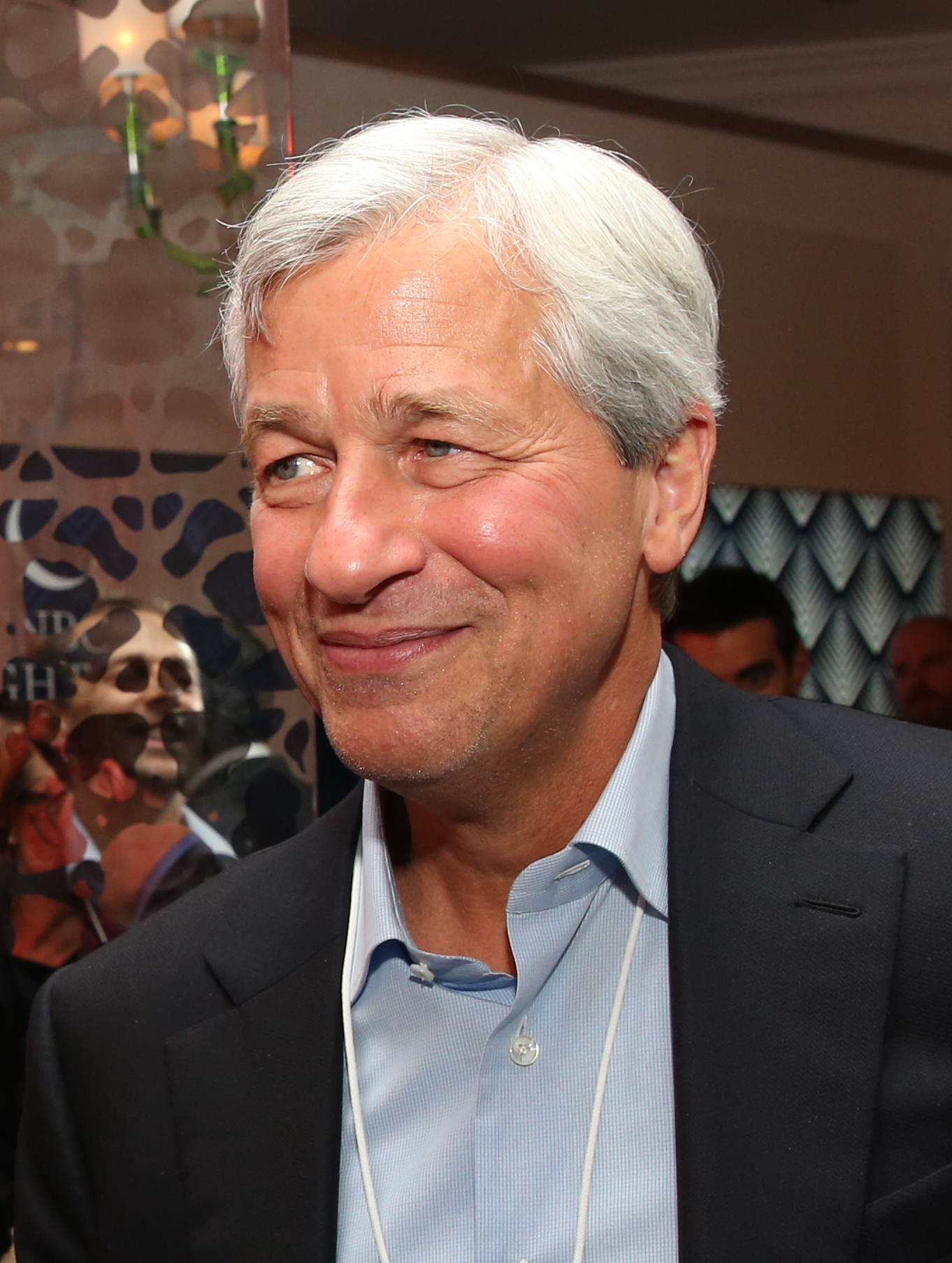

JPMorgan CEO Says 30% Chance of Stock Market Crash Within Two Years

By Jake Beardslee · October 11, 2025

CEO Raises Alarm Over Market Stability

JPMorgan Chase CEO Jamie Dimon has sounded a cautionary note about the U.S. stock market’s near future, saying he is significantly more concerned than his peers about the risk of a major downturn. Speaking with BBC Business Editor Simon Jack, Dimon said, “I am far more worried about that than others.” Doral Chenoweth / USA TODAY NETWORK via Imagn Images

Probability of a Crash 'Higher Than Priced In'

Dimon estimated the likelihood of a crash at roughly “30 percent” within the next two years, a figure he believes is much higher than what investors currently expect. “Now, I’m talking about probabilities,” he explained. “If the market’s pricing in 10 percent, I would price in, I would say, it’s more like 30 percent.” He declined to specify an exact timeframe but suggested it could occur within six months to two years. Maxim Hopman / Unsplash

Geopolitical and Fiscal Uncertainty Weighs Heavily

The banking executive cited a convergence of risks driving his unease, including global geopolitical tensions, rising fiscal spending, political volatility, and the “remilitarization of the world.” He added, “A lot of issues that we don’t know how they’re gonna sort out. So I say the level of uncertainty should be higher in most people’s minds than what I call normal.” Financial Times, CC BY 2.0 https://creativecommons.org/licenses/by/2.0, via Wikimedia Commons

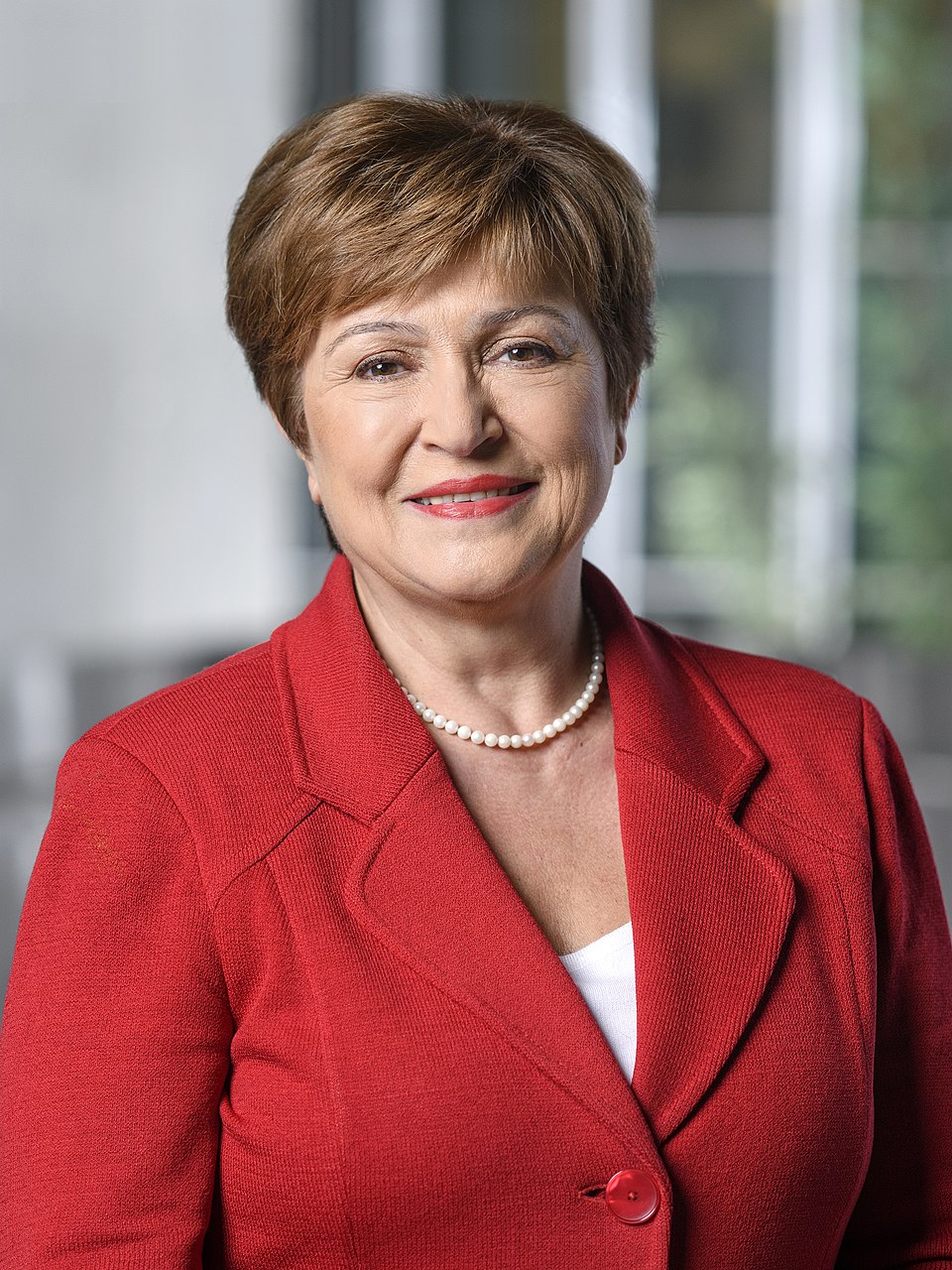

IMF Chief Echoes Warnings of Volatile Global Outlook

Dimon’s concerns echoed those of Kristalina Georgieva, managing director of the International Monetary Fund, who recently cautioned that “uncertainty is the new normal.” Despite the global economy’s resilience to President Donald Trump’s ongoing tariff policies, Georgieva said consumers should “buckle up.” World Bank Group/ Grant Ellis, CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0, via Wikimedia Commons

Tariffs and Inflation Contiue to Drag

In earlier comments, Dimon expressed skepticism about the long-term strength of Trump’s economy, noting persistent inflation and slowing job growth. On the Office Hours: Business Edition podcast, he said many of the effects of Trump’s tariffs have yet to fully materialize: “People are expecting these things to happen right away. But actually, a lot of [the effects of the tariffs] haven’t happened [yet].” The White House / Wikimedia

Dimon Cautions on Weakening Economy

During an appearance on CNBC, Dimon stopped short of predicting a formal recession but reiterated that “the economy is weakening.” He added that declining consumer confidence and unpredictable interest rate shifts could complicate recovery efforts, saying, “There’s a lot of different factors in the economy right now. We just have to wait and see.” Steve Jurvetson, CC BY 2.0 https://creativecommons.org/licenses/by/2.0, via Wikimedia Commons