U.S. News

Biden’s Student Debt SAVE Plan Blocked by U.S. Appeals Court

By Jake Beardslee · February 18, 2025

Appeals Court Sides with Republican-Led States

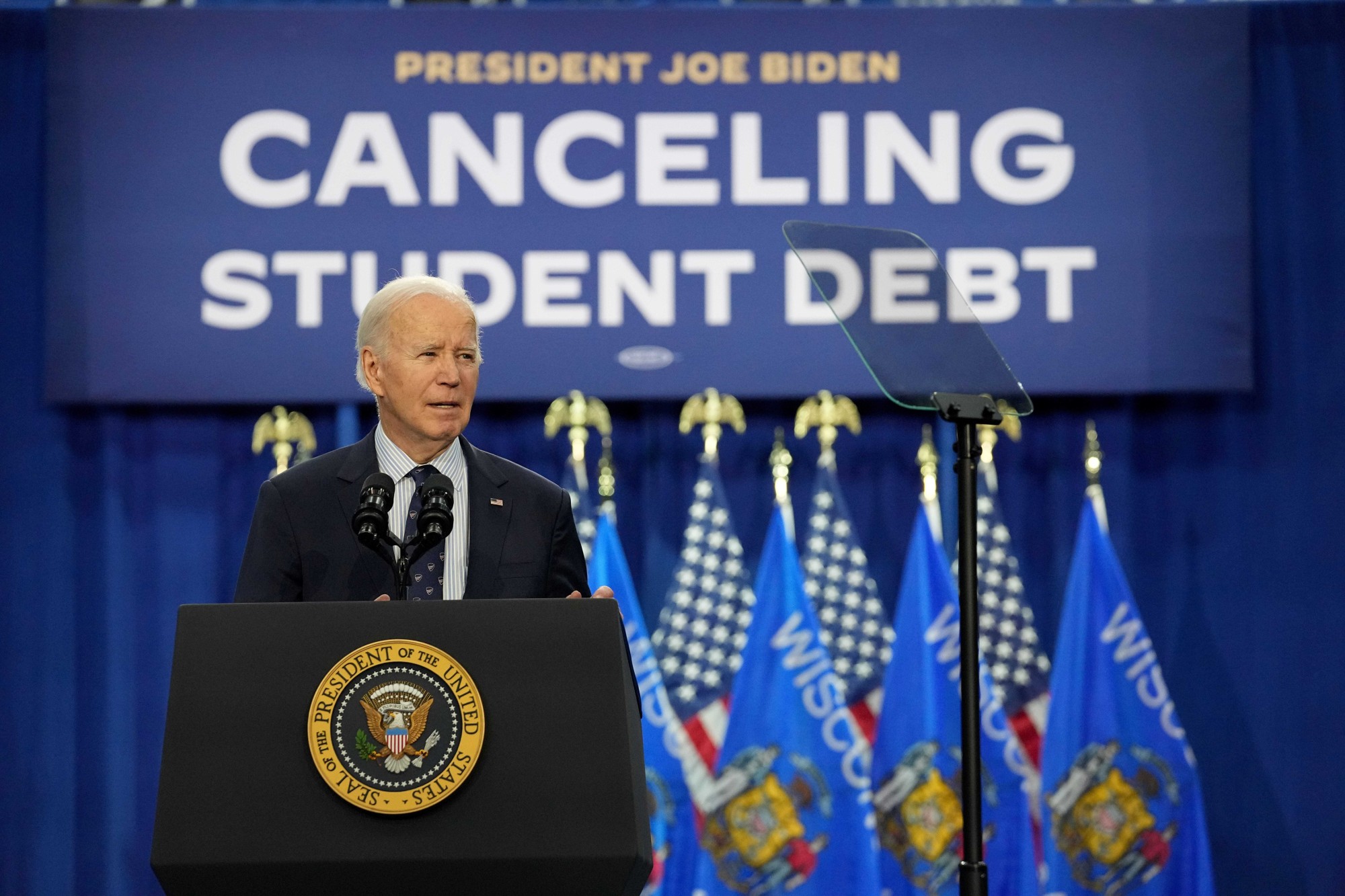

A U.S. appeals court has blocked the Biden administration's student loan relief plan, known as the SAVE plan, a move that could significantly impact millions of borrowers by increasing their monthly payments.On Tuesday, the 8th U.S. Circuit Court of Appeals ruled in favor of seven Republican-led states challenging the U.S. Department of Education’s initiative. The states contended that President Joe Biden lacked the legal authority to implement the program, mirroring arguments that led the Supreme Court to strike down his broader debt cancellation plan in June 2023. Mark Hoffman/Milwaukee Journal Sentinel via USA TODAY Network / USA TODAY NETWORK via Imagn Images

GOP Criticism of the SAVE Plan

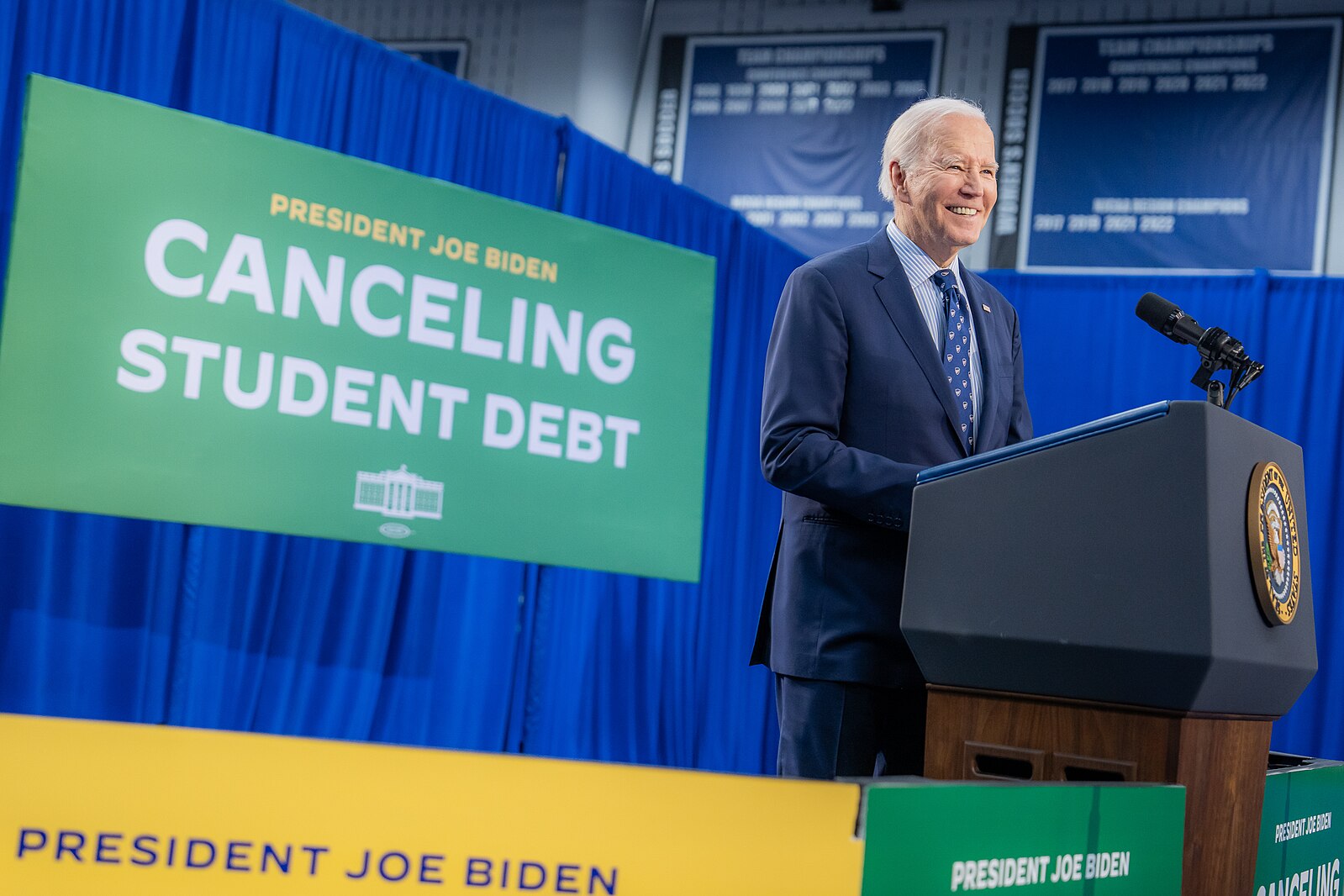

Republicans claim that the SAVE plan, short for Saving on a Valuable Education, was a workaround for Biden to provide debt relief after the earlier plan was halted. The SAVE program aimed to offer lower monthly payments and quicker debt forgiveness for those with small loan balances. However, the projected cost of implementing SAVE—estimated at $475 billion over the next decade by the University of Pennsylvania's Penn Wharton Budget Model—made it a political target for Republicans, who argue that taxpayers should not bear the burden of subsidizing higher education costs. The White House / Wikimedia

Consumer Advocates Defend Affordable Repayment Options

Consumer advocates counter that most families need to borrow money for college and require affordable repayment options. Studies reveal that student loans hinder economic activities such as starting businesses, purchasing homes, and having children.For instance, research indicates that a $1,000 increase in student loan debt lowers the homeownership rate by about 1.8 percentage points among public four-year college attendees in their mid-20s. Additionally, higher levels of student debt are associated with lower rates of entrepreneurship and poorer health behaviors. OleksandrPidvalnyi / Pixabay

Potential Impact of GOP Proposals

The timing of the court's decision coincides with new proposals from House Republicans that could further increase federal student loan bills. According to an estimate by The Institute for College Access & Success, the average borrower could face an additional $200 monthly payment if these GOP plans are enacted. Republicans propose using the additional revenue to fund tax cuts initiated during President Donald Trump's administration. Kaboompics.com / Pexels